Despite the downturn, EdTech continues to be an attractive investment opportunity for venture capitalists. The sector’s growth prospects remain strong, driven by the increasing adoption of technology and online learning, rising demand for upskilling and reskilling, and the growing number of K-12 and higher education students in the country. According to a report by Blume Ventures, the EdTech market in India is expected to grow at a CAGR of 39% to reach $10.4 billion by 2025. While I doubt they will concur with their report now and are likely to focus on alt sectors, the macro indicators underlying the EdTech investment outbreak in 2021 are still positive.

Dealroom reported a decline in EdTech activity in private and public markets in 2022 compared to the previous year due to several factors, including the pandemic-induced economic slowdown, rising inflation, and tighter regulatory scrutiny. The sector’s growth was partly fueled by the surge in online learning during the pandemic, and as things have started to return to normal, the growth has slowed down. This especially followed suit in India, where most EdTech companies saw themselves either running out of runway or raising down-rounds. The real status, of course, becomes clearer in the L2 divisions of the sector.

The EdTech sector in India is divided into three major sub-sectors, namely, K-12, higher education, upskilling and reskilling, and each sub-sector presents unique opportunities for investment. The three sub-sectors are solving drastically different problems of different segments. Only one, in my opinion, is slated to create true value.

K-12: The Kids are Addicted & the Government is Worried

The K-12 EdTech sector focuses on providing digital learning solutions for school students. The sector has witnessed significant growth in recent years, with various companies providing digital content, adaptive learning platforms, and personalised learning solutions. However, investing in this sector can be tricky, as it is highly dependent on government policies and the quality of the education system in the country.

- BYJU’S: Despite the media frenzy, BYJU’S remains one of the leading EdTech companies in India, providing digital learning solutions for K-12 students. The company has raised over $2 billion in funding and has a valuation of $18 billion.

- Vedantu: Vedantu is an online tutoring platform that provides live classes for K-12 students. The company has raised over $200 million in funding and has a valuation of $1.1 billion.

- Toppr: Toppr is an online learning platform that provides personalized learning solutions for K-12 students. The company has raised over $100 million in funding and has a valuation of $800 million.

Gyan is a short, single-line takeaway in the blog, just in case you’re breezing through the long readGyan: The government of India recently announced "Pragyata", their new guidelines for online education, which require EdTech companies to comply with a set of rules and regulations, including minimum qualifications for teachers and accreditation requirements.

While companies like BYJU’S, Vedantu, and Toppr are leaders in this space, they have faced regulatory challenges in the past. The government of India recently announced new guidelines for online education, which require EdTech companies to comply with a set of rules and regulations, including minimum qualifications for teachers and accreditation requirements. Therefore, investors looking to invest in K-12 EdTech companies need to keep a close eye on regulatory developments.

Higher Education: A quality problem borrowed from their offline counterparts

The Higher Education EdTech sector focuses on providing digital learning solutions for college and university students. The sector has witnessed significant growth in recent years, with various companies providing online degree programs, online certification courses, and digital content. Some of the top investment opportunities in the Higher Education EdTech sector include:

- upGrad: upGrad is an online learning platform that provides degree programs, certification courses, and executive education programs. The company has raised over $290 million in funding and has a valuation of $2 billion.

- Simplilearn: Simplilearn is an online learning platform that provides certification courses in various domains such as data science, cloud computing, and digital marketing. The company has raised over $50 million in funding and has a valuation of $300 million.

- Emeritus: Emeritus is an online learning platform that provides executive education programs in collaboration with top universities such as MIT, Columbia, and Wharton. The company has raised over $185 million in funding and has a valuation of $2 billion.

Companies like upGrad, Simplilearn, and Emeritus are leading players in this space and have raised significant funding in recent years. However, investing in this sector requires a careful analysis of the market, competition, and quality of online education offerings. The success of these companies is highly dependent on their ability to offer high-quality education that is comparable to traditional classroom-based education.

Upskilling and Reskilling: The Only Way Out

The Upskilling and Reskilling EdTech sector focuses on providing digital learning solutions for working professionals. The sector has witnessed significant growth in recent years, with various companies providing online courses and certifications to upskill and reskill employees. Some of the top investment opportunities in the Upskilling and Reskilling EdTech sector include:

- Simplilearn: Simplilearn is an online learning platform that provides certification courses in various domains such as data science, cloud computing, and digital marketing. The company has raised over $50 million in funding and has a valuation of $300 million, with its latest round led by global venture capital firm, Sixth Sense Ventures.

- Springboard: Springboard is an online learning platform that provides certification courses in emerging technologies such as AI, data science, and machine learning. The company has raised over $30 million in funding and has a valuation of $350 million, with its latest round led by Reach Capital.

- Scaler: Scaler is an online learning platform that provides coding and programming courses to upskill and reskill. It raised USD 20 million in funding led by Strive.

The upskilling and reskilling sub-sector of the EdTech industry presents a unique opportunity. With the world becoming more technologically advanced, companies are constantly seeking employees with new skill sets. According to a report by the World Economic Forum, by 2025, over half of all employees will require significant reskilling and upskilling. This presents a massive opportunity for EdTech companies to fill this skills gap, making the upskilling and reskilling sub-sector a lucrative investment option.

But why this over that?

A report by HolonIQ states that the upskilling and reskilling market has witnessed a surge in investment, with total funding reaching USD $87bn+ of Global EdTech funding predicted through 2030. $32bn last decade. The report also highlights that upskilling and reskilling programs are the most sought-after offerings by corporates, with 64% of them citing this as a priority. Furthermore, a report by McKinsey Global Institute suggests that the upskilling and reskilling of employees can have a significant positive impact on a company’s bottom line. The report highlights that companies that invest in upskilling and reskilling can see a 6-9% increase in profit margins.

Looking even closer, there are only two facts to marry:

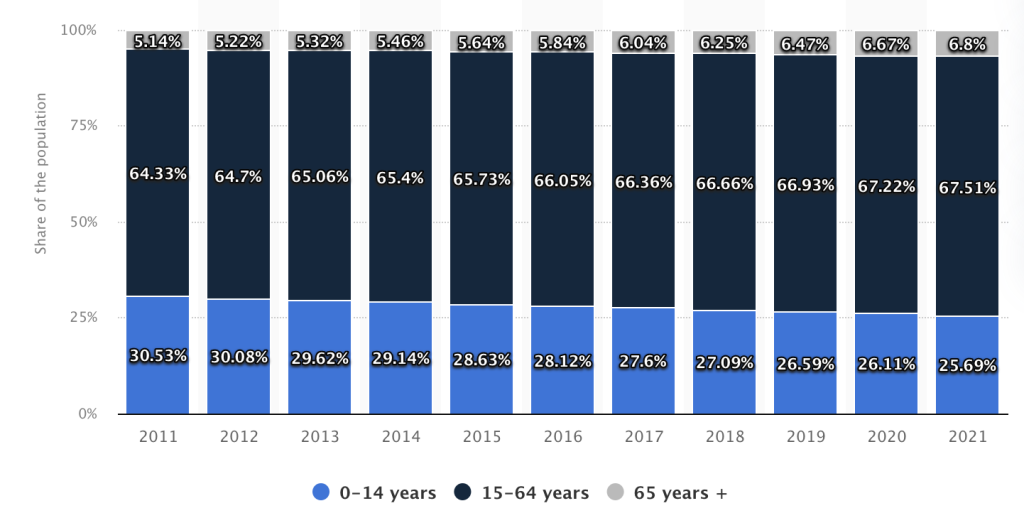

- There are over 100 million individuals set to enter the workforce in India over the next 5 years.

- The wider higher-ed environment is not equipped to churn out quality candidates

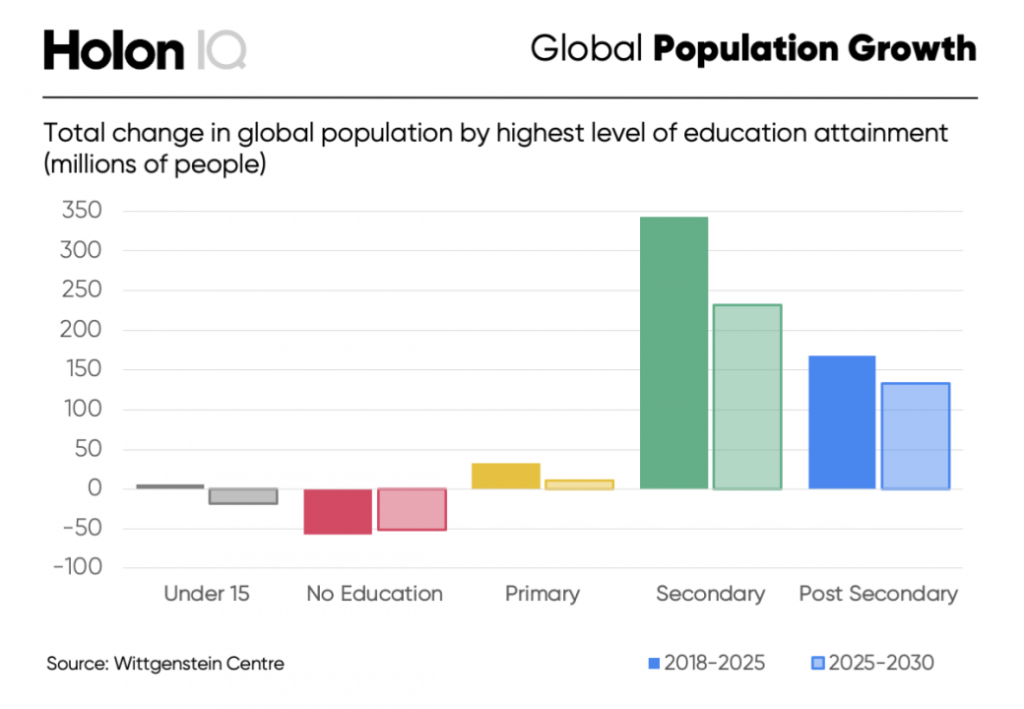

That is the gap. HolonIQ identified a similar gap in 2019 on a global level.

Gyan is a short, single-line takeaway in the blog, just in case you’re breezing through the long readGyan: Upskilling and reskilling are able to extract a higher revenue per user (RPU) than K-12 & Higher-Ed players as they charge corporate clients, and the courses they offer are typically shorter in duration.

The upskilling and reskilling business model typically operates in the B2B space, catering to the needs of corporate clients. EdTech companies provide short-term, high-quality courses designed to upskill and reskill employees in various domains such as data science, cloud computing, and digital marketing. These courses provide specific and valuable skill sets that the job market demands, and consequently tend to be priced far higher than K-12 or higher education courses. This leads to a higher revenue per user (RPU) and a shorter customer acquisition cost (CAC), resulting in a higher lifetime value (LTV) per customer. These companies typically have a diversified client base across various industries, which reduces the risk of revenue loss in case of any economic downturn or regulatory scrutiny. Overall, the upskilling and reskilling business model is attractive due to its (1) high-profit margins, (2) shorter course durations, and (3) less vulnerability to external factors.

In Conclusion

Gyan is a short, single-line takeaway in the blog, just in case you’re breezing through the long readGyan: According to the EY PE/VC Trend Book, the decline in EdTech activity is part of a broader trend of a slowdown in the Indian startup ecosystem, and not an isolated event due to changes in the EdTech market.

According to the EY PE/VC Trend Book, the decline in EdTech activity is part of a broader trend of a slowdown in the Indian startup ecosystem and not an isolated event due to changes in the EdTech market. The report highlights that the total value of investments in Indian startups declined by 26% in 2022 compared to the previous year. The report also states that investors are becoming more cautious and are focusing on companies with strong fundamentals, which could be a reason for the decline in EdTech activity.

The EdTech industry in India continues to present a multitude of investment opportunities that were originally recognised at the start of 2020, with each sub-sector presenting unique prospects. While the K-12 and higher education segments have witnessed significant growth in recent years, investing in the upskilling and reskilling segment can be a better option due to the untapped market, diversification of client base, and higher profitability. As the demand for upskilling and reskilling programs continues to rise, investing in EdTech companies that provide these services can yield significant returns. However, as with any investment, it is essential to conduct thorough due diligence and invest in companies with strong fundamentals and growth prospects.